VICTOR ANASIMIV

I am a top-ranking mortgage broker with Dominion Lending Centres, Modern Mortgage Group. Honest & open communication and providing outstanding customer service has been my goal since I started my mortgage brokering career in 2008.

As a longtime Comox Valley resident I know the area very well and I'm active in my community. While my target market is Vancouver Island, I also arrange many mortgages each year across Canada.

Having bought a number of different properties over the years, I know first hand that purchasing real estate is an exciting and sometimes stressful period. It is my goal to make your mortgage experience a smooth and easy process.

Are you buying or refinancing? Either way, I've got you covered. Whether it's a big bank, a smaller credit union, or a trust company you may have never heard of, I have access to many different lenders to fund your mortgage.

You've got a busy life. Relax and let me be your personal mortgage shopper.

Understanding mortgage financing can be difficult, it doesn't have to be. Here's the plan!

Connect directly

The process starts when you get in touch. Let's take a look at your financial situation and put together a plan to

find the best mortgage for you!

Discuss your options

When it comes to mortgage financing, you have options! Let's clarify those options, so you can make the decision that best suits your needs.

Arrange the paperwork

Paperwork is the nitty gritty of mortgage financing. Let's make sure you know exactly what is required of you at every step, limiting any delays.

Lifetime support

As long as you need a mortgage, be assured that you'll receive ongoing professional mortgage advice. Connect anytime!

I can help you arrange mortgage financing for the following services:

Lenders

I've developed excellent relationships with many lenders across the country.

Let's figure out which one has the best product for you.

Mortgage Articles

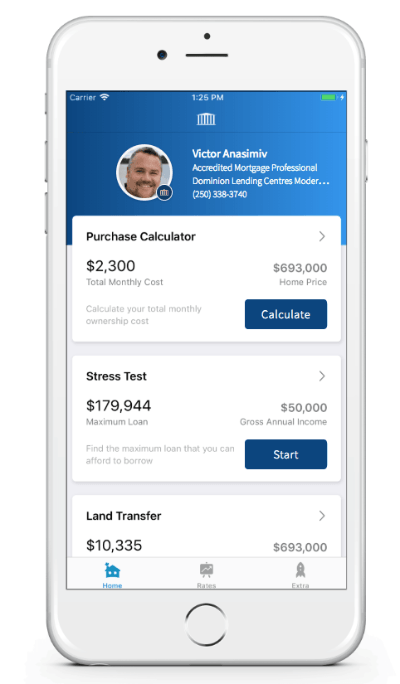

Download My Mortgage Toolbox

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Send a Message

Send A Message

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Victor Anasimiv. All Rights Reserved | DLC